Calculate Gross To Net Pay Ontario

Enter your pay rate. The Ontario Income Tax Salary Calculator is updated 202122 tax year.

How To Calculate Gross Pay To Net Pay Workest

Formula for calculating net salary The annual net income is calculated by subtracting the amounts related to the tax Canada Tax and Ontario Tax the Ontario surtax the Canadian Pension Plan the Employment Insurance.

Calculate gross to net pay ontario. Salary calculations include gross annual income tax deductible elements such as Child Care Alimony. Fill in the boxes below that apply to you to convert your actual pay or your payrate. Is calculated based on a persons gross taxable income after the non-refundable tax credits have been applied QPIP CPPQPP and EI premiums.

As a result your employer may be using a different Yukon Basic Personal Amount to calculate your pay. Enter your annual income taxes paid RRSP contribution into our calculator to estimate your return. The latest budget information from April 2021 is used to show you exactly what you need to know.

Ontario Salary Examples. PaymentEvolution provides simple fast and free payroll calculator and payroll deductions online calculator for accountants and small businesses across Canada. This difference will be reconciled when you file your 2020 tax return.

If You are looking to calculate your salary in a different province in Canada you can select an alternate province here. The Ontario Income Tax Salary Calculator is updated 202122 tax year. The annual net income is calculated by subtracting the amounts related to the tax Canada Tax and Ontario Tax the Ontario surtax the Canadian Pension Plan the Employment Insurance.

Easy income tax calculator for an accurate Ontario tax return estimate. Income Tax calculations and RRSP factoring for 202122 with historical pay figures on average earnings in Canada for each market sector and location. When it comes to discussing and agreeing on pay for your household caregiver whether youve hired a nanny senior care provider or live-in housekeeper the difference between net gross and out of pocket pay matters.

The calculator is updated with the tax rates of all Canadian provinces and territories. Why knowing the difference between Net Gross and out of pocket pay is important. Gross annual income - Taxes - Surtax - CPP - EI Net annual salary Net annual salary Weeks of work year Net weekly income.

Hourly rates weekly pay and bonuses are also catered for. Your 2020 Ontario income tax refund could be even bigger this year. The amount can be hourly daily weekly monthly or even annual earnings.

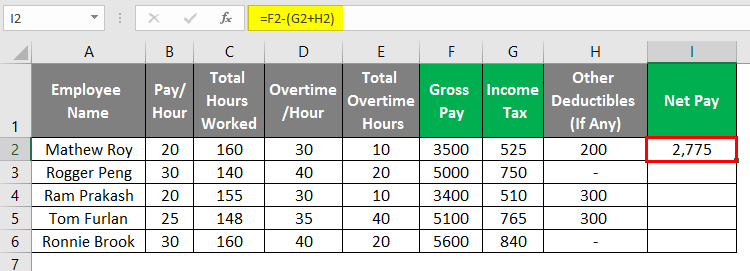

Now just multiply that amount by the Vacation Rate like 230000 004 9200 Vacation Pay To Accrue or Not to Accrue. Gross pay payroll tax other deductions Net pay The payroll tax and deductions mentioned above include the Federal tax deduction Provincial tax deduction CPP deduction and EI deduction which is usually deducted before the employee receives payment and forwarded to the government. Why not find your dream salary too.

Generally most people think of a month as having 4 weeks. If you make 52000 a year living in the region of Ontario Canada you will be taxed 11488. Formula for calculating net salary Gross annual income Taxes Surtax CPP EI Net annual salary Net annual salary Weeks of work year Net weekly income Net weekly income Hours of work week Net hourly wage.

If this is the case you may see a difference between your pay and the Payroll Deductions Online Calculator. You can use the calculator to compare your salaries between 2017 2018 2019 and 2020. This marginal tax rate means that your immediate additional income will be taxed at this rate.

This calculator is for you. If an employee is entitled to 4 Vacation Pay and their Gross Wages are 200000 Regular Wages 20000 Overtime 10000 Stat Pay 230000 Gross Wages. Gross pay is what you make before any deductions are made taxes etc.

Income Tax calculations and RRSP factoring for 202122 with historical pay figures on average earnings in Canada for each market sector and location. But 4 weeks multiplied by 12 months 48. Your average tax rate is 221 and your marginal tax rate is 349.

Usage of the Payroll Calculator. The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan. There are 12 months and 52 weeks in a year.

Gross Salary Calculator Need to start with an employees net after-tax pay and work your way back to gross pay. The tax is progressive five tax brackets it starts at 15 for incomes up to 49020 CAD and ends at 33 for incomes greater than 216511 CAD. That means that your net pay will be 40512 per year or 3376 per month.

Gross annual income Taxes Surtax CPP EI Net annual salary Net annual salary Weeks of work.

What Is Payroll Basics Process More Greythr Payroll Payroll Software Tax Saving Investment

5 3 Explanation Interpretation Of Article V Under U S Law Canada U S Tax Treaty Rental Income Interpretation Real Estate Rentals

37 000 After Tax 2021 Income Tax Uk

Mathematics For Work And Everyday Life

Payroll In Excel How To Create Payroll In Excel With Steps

2021 Salary Paycheck Calculator 2021 Hourly Wage To Yearly Salary Conversion Calculator

Financial Literacy Grade 5 Ontario Curriculum For Use With Google Slides Video Video In 2021 Ontario Curriculum Financial Literacy Literacy

Excel Formula Income Tax Bracket Calculation Exceljet

Avanti Gross Salary Calculator

How To Calculate Income Tax In Excel

Mathematics For Work And Everyday Life

Start From Zero Invest Passively And Retire In 10 Years Investing For Retirement Investing Retirement

Pin On Economic Perceptions Of China

How To Calculate Income Tax In Excel

Financial Literacy Reading A Pay Stub Financial Literacy High School Math Activities Literacy

Post a Comment for "Calculate Gross To Net Pay Ontario"