Paycheck Calculator With 401k And Hsa

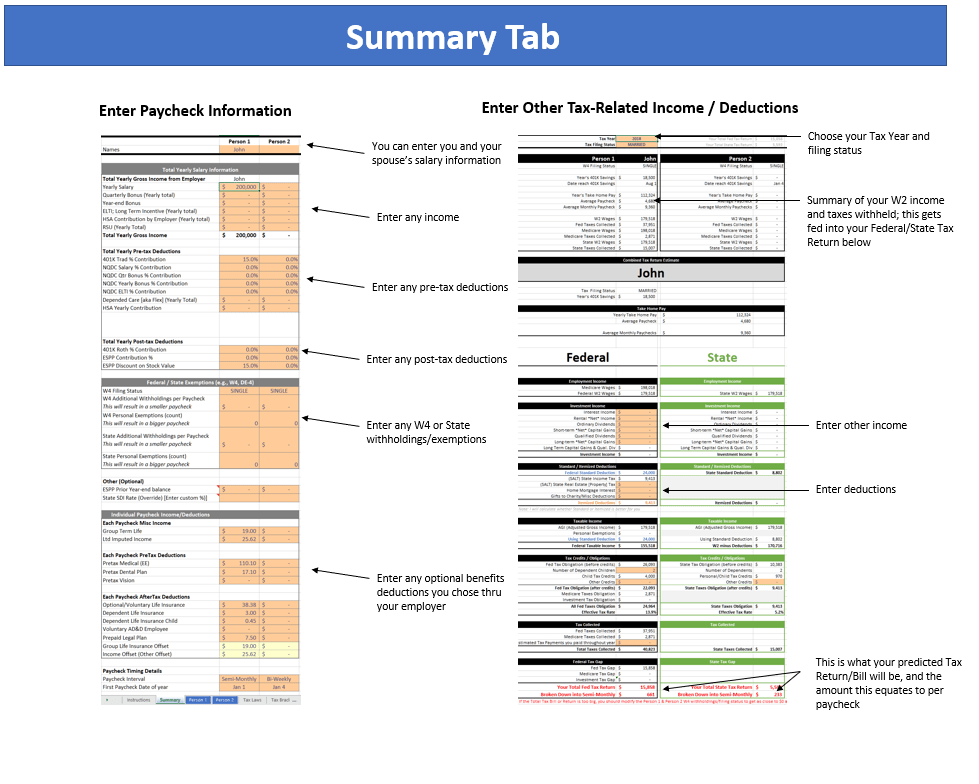

This calculator will help to determine your paycheck amount after taxes and benefit deductions have been subtracted. You should always consult with your financial planner attorney andor tax advisor as needed.

Paycheck Calculator Salaried Employees Primepay

Estimate Salary Paychecks After Required Tax Deduction 401K or 403B Contributions.

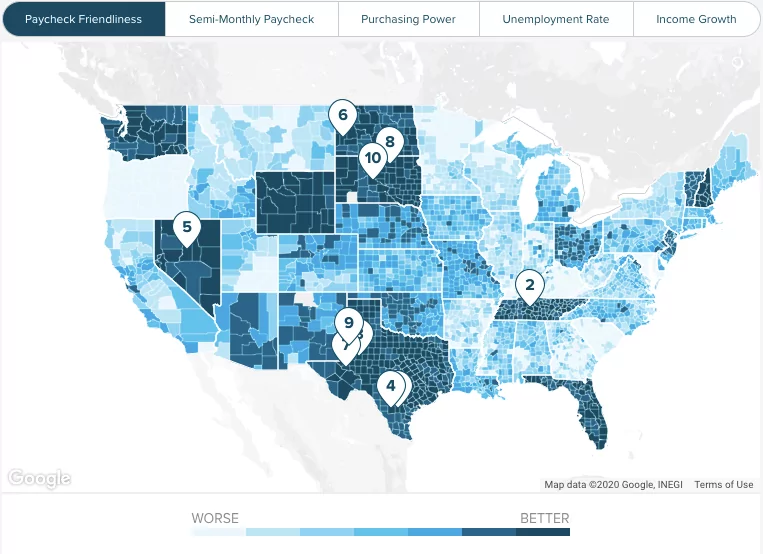

Paycheck calculator with 401k and hsa. This online paycheck calculator with overtime and claimed tips will estimate your net take-home pay after deductions and federal state and local income tax withholding. The output provided by any calculator depends upon the completeness and the accuracy of the information and assumptions that the user provides. We then indexed the paycheck amount for each county to reflect the counties with the lowest withholding burden or.

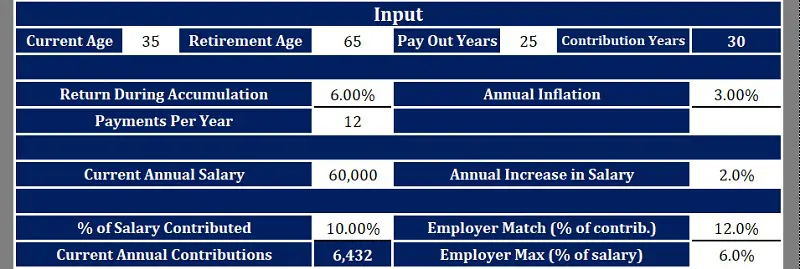

Salary paycheck calculator guide. Saving for Retirement. From there enter your annual contribution annual catch-up contribution and both the federal and state tax percentages.

401K Calculator Calculator to see how increasing your contributions to a 401k can affect your paycheck and your retirement savings. This calculator uses the withholding schedules. The impact on your paycheck might be less than you think.

Determine taxable income by deducting any pre-tax contributions to benefits. We applied relevant deductions and exemptions before calculating income tax withholding. This number is the gross pay per pay period.

Thats where our paycheck calculator comes in. Long Term Disability Insurance Life Insurance. Plus the paycheck tax calculator includes a built-in state.

The calculator is provided for educational purposes only and does not serve either directly or indirectly as legal financial or tax advice. This calculator will show you just how much you are saving in taxes by making contributions to a Health Savings Account HSA. Payroll calculator tools to help with personal salary retirement and investment calculations.

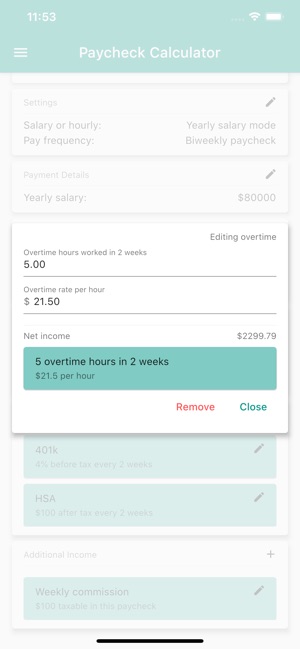

This powerful tool does all the gross-to-net calculations to estimate take-home net pay in any part of the United States. To better compare withholding across counties we assumed a 50000 annual income. That represents an increase in your take home.

Withhold all applicable taxes federal state and local Deduct any post-tax. You can also use the calculator to calculate hypothetical raises adjustments in retirement contributions and changes to medical insurance premiums. When you make a pre-tax contribution to your retirement savings account you add the amount of the contribution to your account but your take home pay is reduced by less than the amount of your contribution.

While your plan may not have a deferral percentage limit this calculator limits deferrals to 80 to account for FICA Social Security and Medicare taxes. At AccuPay our goal is to provide our clients with accurate timely payroll and HR services backed by exceptional customer service. Knowing how much your current 401 k account may accumulate in the future can help you determine if you should adjust your annual 401 k contributions to help reach your retirement goals.

401 k Contribution Effects on Your Paycheck Calculator Definitions Current 401 k contribution This is the percentage of your annual salary you contribute to your 401 k plan each year. Free calculator to find the actual paycheck amount taken home after taxes and deductions from salary or to learn more about income tax in the US. How to calculate net income.

Salary Paycheck Calculator How much are your wages after taxes. Simply enter the information into the form and youll get your results. While your plan may not have a deferral percentage limit this calculator limits deferrals to 75 to account for FICA Social Security and Medicare taxes.

Due to the coronavirus crisis and changes in the US federal tax code from the recently passed American Rescue Plan Act of 2021 the tax filing date for individuals to pay their 2020 income taxes was moved by the IRS from April 15 2021 to May 172021. First indicate if you are insuring just yourself or your family. This calculator is designed to show you how making a pre-tax contribution to your retirement savings plan could affect your take home pay.

Our free salary paycheck calculator below can help you and your employees estimate their paycheck ahead of time. Can be used by salary earners self-employed or independent contractors. Use this calculator to see how increasing your contributions to a 401k can affect your paycheck as well as your retirement savings.

Also explore hundreds of other calculators addressing topics such as tax finance math fitness health and many more. Subtract any deductions and payroll taxes from the gross pay to get net pay. First we calculated the semi-monthly paycheck for a single individual with two personal allowances.

Enter your annual salary or earnings per pay period. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. Use these free retirement calculators to determine how much to save for retirement project savings income 401K Roth IRA and more.

The federal government collects your income tax payments gradually throughout the year by taking directly from each of your paychecks. Tax withholding is the money that comes out of your paycheck in order to pay taxes with the biggest one being income taxes. Although our salary paycheck calculator does much of the heavy lifting it may be helpful to take a closer look at a few of the calculations that are essential to payroll.

Please note that your 401k or 403b plan contributions may be limited to less than 80 of your income. In addition to our free salary paycheck calculator our. If your contributions exceed the 2018 limits the calculator will automatically.

Our 401 k Growth Calculator is a simple and easy way to estimate the long-term growth of your 401 k retirement account by the time you want to retire. Free 2020 Employee Payroll Deductions Calculator Important. Dont want to calculate this by hand.

This calculator uses the latest withholding schedules rules and rates IRS Publication 15. You can choose between weekly bi-weekly semi-monthly monthly quarterly semi-annual and annual pay periods and between single married or head of household. Check with your plan.

Us Paycheck Calculator Queryaide

401k Catch Up Contributions In 2021 Myubiquity Com

Free Paycheck Calculator Hourly Salary Usa Dremployee

Using A Salary Paycheck Calculator To Help Solve The Payroll Equation

The Salary Paycheck Calculator Paydata

Hourly Paycheck Calculator Business Org

Advanced Paycheck Tax Calculator By Ryan Smith Soothsawyer

Free Paycheck Calculator Hourly Salary Usa Dremployee

Free Online Paycheck Calculator Calculate Take Home Pay 2021

Paycheck Calculator Us On The App Store

401 K Calculator Paycheck Tools National Payroll Week

Free Paycheck Calculator Hourly Salary Usa Dremployee

Advanced Paycheck Tax Calculator By Ryan Smith Soothsawyer

Post a Comment for "Paycheck Calculator With 401k And Hsa"