Payroll Calculator Using 2020 W4

Updated for your 2020-2021 taxes simply enter your tax information and adjust your withholding to see how it affects your tax refund and your take-home pay on each paycheck. Pay Periods per Year.

2020 Federal W4 Updates Cic Plus

When a user clicks the calculate button the results of each calculation will be displayed side by side.

Payroll calculator using 2020 w4. Estimate your paycheck withholding with TurboTaxs free W-4 Withholding Calculator. If you use an automated payroll system you do not need to use the Assistant. The Form W4 provides your employer with the details on how much federal and in some cases state and local tax should be withheld from your paycheck.

Determine taxable income by. For the remainder of 2020 the CRA will expect this change to be implemented on a best efforts basis. Use the Tax Withholding Estimator Why Use the Estimator.

However if you like to calculate the taxes manually you can find. If this is the case you may see a difference between your pay and the Payroll Deductions Online Calculator. If it shows Taxes owed decrease your W-4 Allowances now.

Start the free 2020 W-4 Tax Withholding Calculator. What you do not know is if the Allowance adjustment will result in your goal not to owe Taxes in 2020. 2020 W4 federal withholding not calculating Withholding is not being calculated even though I entered the dollar amount for the 2020 W4.

Calculating Employee Payroll Taxes in 5 Steps. Find out now before you submit your W-4 to your employer and estimate your 2020 Return now. PaycheckCity calculators will support the pre-2020 Form W-4 as well as the 2020 Form W-4 elections.

Once your employees are set up and your business is set up too youre ready to figure out the wages the employee has earned and the amount of taxes that need to be withheldAnd if necessary making deductions for things like health insurance retirement benefits or garnishments as well as adding back expense reimbursements. I have downloaded new payroll tax table and done the payroll update. Your net Paycheck will decrease.

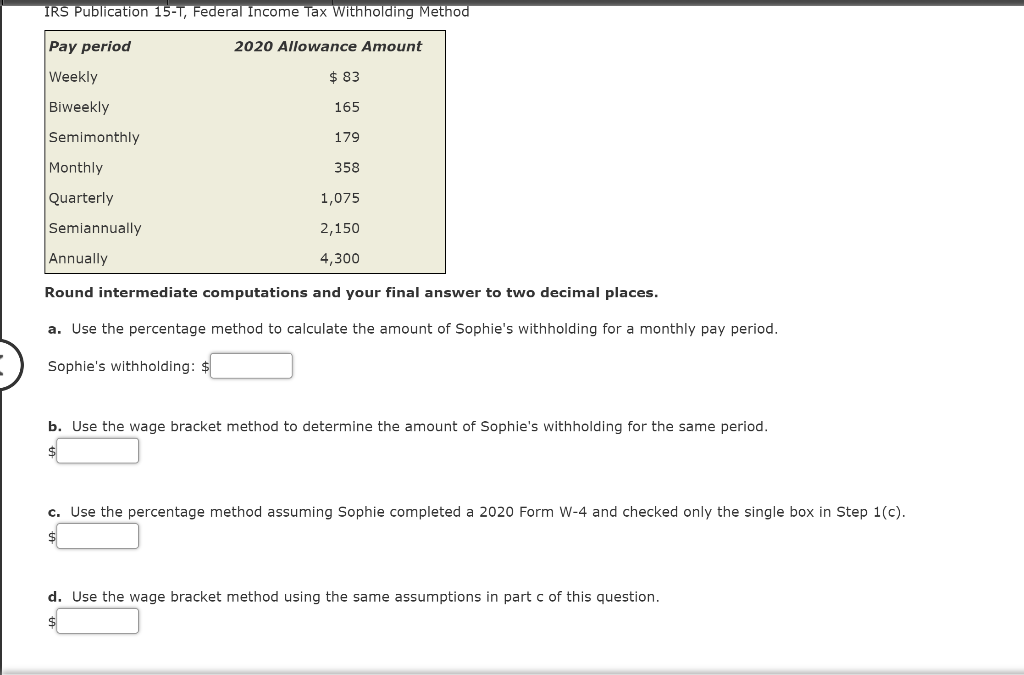

Remember Logan was paid on a weekly basis so we use the weekly payroll period table. Dont include any wages you got in 2020. The calculator generates your official IRS W-4 Form that you can print or email.

For Payroll in Tax Year. Individuals who are using the pre-2020 W-4 should leave this checkbox blank. And when youre done you can schedule a complimentary consultation with a tax pro for additional help.

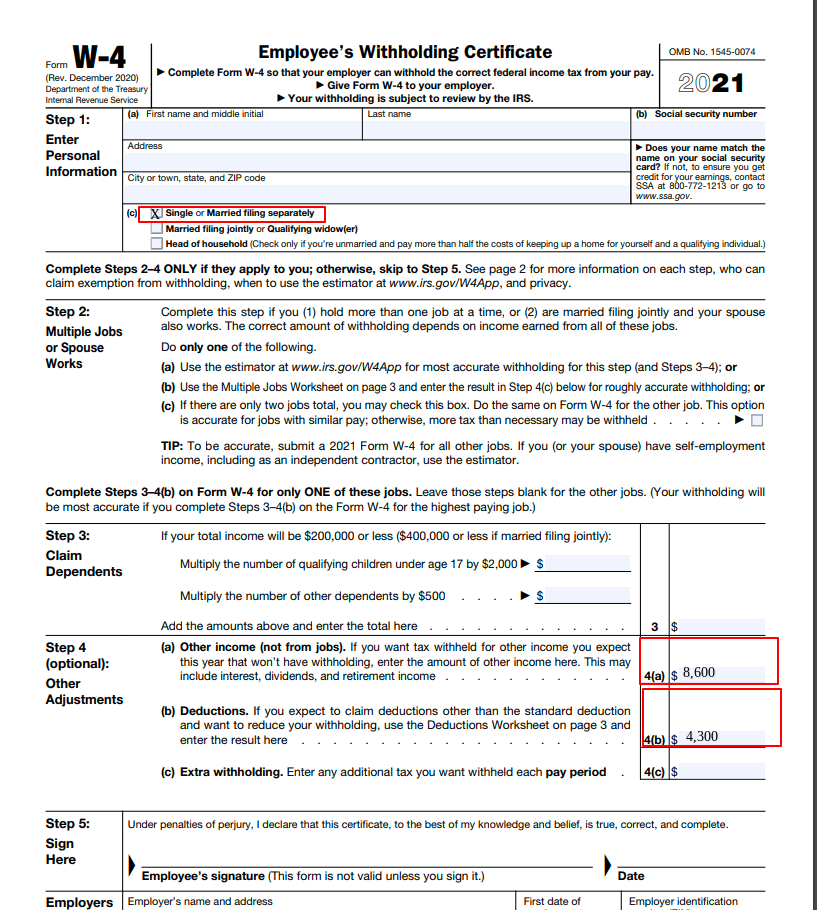

The calculator on the left has the 2019 W-4 selected whereas the calculator on the right has the 2020 updated W-4 with automatically adjusted fields. Individuals who are using the 2020 Form W-4 should use the 2020 W-4 checkbox which will update the calculator settings to include the appropriate fields. Also remember Logan selected Head of Household as his filing status and did not check the box in Step 2 on his Form W-4.

The Form W4 Withholding Calculator takes you through each step of completing the Form W4. Salary paycheck calculator guide. This selection is done via the Use 2020 W-4 drop down field within the calculator.

The IRS encourages everyone to use the Tax Withholding Estimator to perform a paycheck checkup This will help you make sure you have the right amount of tax withheld from your paycheck. How to calculate net income. Or use this Federal Only Withholding Calculator.

Below use the free tool and enter some figures from your pay or estimated pay. Manage your IRS tax withholdings with our W-4 calculator. We use the table titled 2020 Wage Bracket Method Tables for Manual Payroll System with Forms W-4 from 2020 or Later.

It will help you as you transition to the new Form W-4 for 2020 and 2021. How to Calculate 2020 Federal Income Withhold Manually with New 2020 W4 form If your employee filled out the old 2019 Form W4 follow this guide Try ezPaycheck now Buy it now ezPaycheck payroll software speeds up and simplifies payroll tax calculation paycheck printing and tax reporting for small businesses. The easiest way to figure out how to maximize your tax refund or take-home pay.

Although our salary paycheck calculator does much of the heavy lifting it may be helpful to take a closer look at a few of the calculations that are essential to payroll. 2021 Paycheck Tax Withholding Calculator. The Tax Withholding Assistant is available in Excel format.

As a result your employer may be using a different Yukon Basic Personal Amount to calculate your pay. How to Calculate 2020 Federal Income Withhold Manually with 2019 and Earlier W4 form If your employee filled out the new 2020 Form W4 follow this guide Try ezPaycheck now Buy it now ezPaycheck payroll software speeds up and simplifies payroll tax calculation paycheck printing and tax reporting for small businesses. With HR Blocks W-4 calculator youll understand your withholdings and how to adjust them.

Every 4 weeks Once a Month Twice a Month Every 2 Weeks Every Week Other. Or Select a state. Use the Income Tax Withholding Assistant if you typically use Publication 15-T to determine your employees income tax withholding.

However if you like to calculate the taxes manually you can find the step by step.

Https Www Business Org Finance Accounting Salary Payroll Calculator

The Filmmaker S Guide To Entertainment Payroll

2021 New W 4 Form No Allowances Plus Computational Bridge

2021 New W 4 Form No Allowances Plus Computational Bridge

Https Docs Cmicglobal Com Portal Content Resources Pdfs R12 2020 Federal W4 Changes User Doc V12 Pdf

Free Salary Paycheck Calculator Business Org

Payroll Format In Excel Sheet If You Manage A Team Employee Or Busy Household It Is Simple T In 2020 Spreadsheet Template Payroll Spreadsheet

Problem 9 3 Withholding Methods Lo 9 1 Sophie Is A Chegg Com

How To Fill Out And Change Your Form W 4 Withholdings

:max_bytes(150000):strip_icc()/tax_calculator-5bfc325046e0fb00260c61ae.jpg)

Post a Comment for "Payroll Calculator Using 2020 W4"