Take Home Pay Calculator Ontario 2020

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. This calculator is based on 2020 Ontario taxes.

A Handy Power Consumption Calculator For The Appliances In Your Home Power Electricity Consumption Solar Energy

Enter your pay rate.

Take home pay calculator ontario 2020. NewfoundlandPrince Edward IslandNova ScotiaNew BrunswickQuebecOntarioManitobaSaskatchewanAlbertaBritish ColumbiaNorthwest TerritoriesNunavutYukon. Enter the number of hours worked a week. The payroll calculator from ADP is easy-to-use and FREE.

This marginal tax rate means that your immediate additional income will be taxed at this rate. Your average tax rate is 220 and your marginal tax rate is 353. Your take home salary is.

The annual net income is calculated by subtracting the amounts related to the tax Canada Tax and Ontario Tax the Ontario surtax the Canadian Pension Plan the Employment Insurance. Tax Take Home Pay Calculator for 2020xls. It can also be used to help fill steps 3 and 4 of a W-4 form.

The calculator is updated with the tax rates of all Canadian provinces and territories. It is perfect for small business especially those new to doing payroll. If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432.

You can work out your annual salary and take home pay using the Canada salary calculator or look at typical earning by viewing one of the illustrations below. Canadian provincial corporate tax rates for active business income. Finally the payroll calculator requires you to input your employees tax information including any entitled credits along with year-to-date Canada Pension Plan CPP and Employment Insurance EI contributions.

7 rader Easy income tax calculator for an accurate Ontario tax return estimate. To start complete the easy-to-follow form below. 2020 - Includes all rate changes announced up to July 31 2020.

Ontario Salary Calculation - Create and Email. ADP Canada Canadian Payroll Calculator. Annual Tax Calculator 2020.

Your average tax rate is 2758 and your marginal tax rate is 3600. Calculate the tax savings your RRSP contribution generates. Take Home Pay Calculator by Walter Harder Associates.

This calculator is intended for use by US. The category of fishing and hunting guides is not considered in this calculator as it is very specific. Youll then get a breakdown of your total tax liability and take-home pay.

Find out the benefit of that overtime. 2021 - Includes all rate changes announced up to June 15 2021. Single SpouseEligible dep Spouse 1 Child Spouse 2 Children Spouse 3 Children Spouse.

The tool then asks you to enter the employees province of residence and pay frequency weekly biweekly monthly etc. Salary Before Tax your total earnings before any taxes have been deducted. Gross annual income - Taxes - Surtax - CPP - EI Net annual salary.

That means that your net pay will be 40568 per year or 3381 per month. British Columbia Alberta Saskatchewan Manitoba Ontario New Brunswick Nova Scotia Prince Edward Island Newfoundland Yukon Northwest Territories Nunavut. Net annual salary Weeks of work year Net weekly income.

Anonymous accurate FREE way to quickly calculate the termination pay severance package required for an Ontario BC Alberta employee let go from a job. This is required information only if you selected the hourly salary option. For 2021 until september 30 2021 the province of Ontario as decided to make an increase in the minimum wage of 025 over 2020 from 14 to 1425 per hour.

This marginal tax rate means that your immediate additional income will be taxed at this rate. How to use the Take-Home Calculator. You can calculate your Annual take home pay based of your Annual gross income and the tax allowances tax credits and tax brackets as defined in the 2021 Tax Tables.

Enter the number of pay. Simply enter your annual or monthly income into the tax calculator above to find out how taxes in Canada affect your income. Formula for calculating net salary.

Use the simple annual Ontario tax calculator or switch to the advanced. Canadian corporate tax rates for active business income. Use this simple powerful tool whether your staff is paid salary or hourly and for every province or territory in Canada.

000 If you make 10000000 a year Alberta you will be taxed 2758222That means that your net pay will be 7241778 per year or 1200 per month. To use the tax calculator enter your annual salary or the one you would like in the salary box above. The amount can be hourly daily weekly monthly or even annual earnings.

Also known as Gross Income. Formula for calculating net salary The annual net income is calculated by subtracting the amounts related to the tax Canada Tax and Ontario Tax the Ontario surtax the Canadian Pension Plan the Employment Insurance. If you are earning a bonus payment one month enter the value of the bonus into the bonus box for a side-by-side comparison of a normal month and a bonus month.

Personal Income Tax Calculator - 2020. The Ontario Annual Tax Calculator is updated for the 202021 tax year. You can use the calculator to compare your salaries between 2017 2018 2019 and 2020.

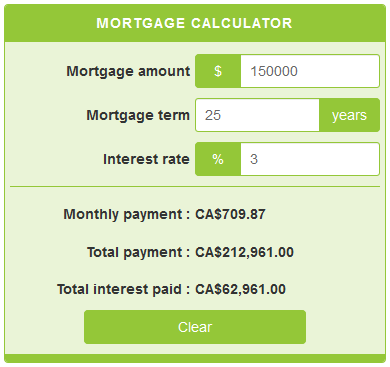

Mortgage Calculator Mortgage Calculator Landmark Finance Calculations Can Become Seriously Troublesome Owing To Online Mortgage Home Mortgage Reverse Mortgage

Six Tips To Avoid An Irs Audit Irs Audit Tips

Mortgage Calculator Calculatorscanada Ca

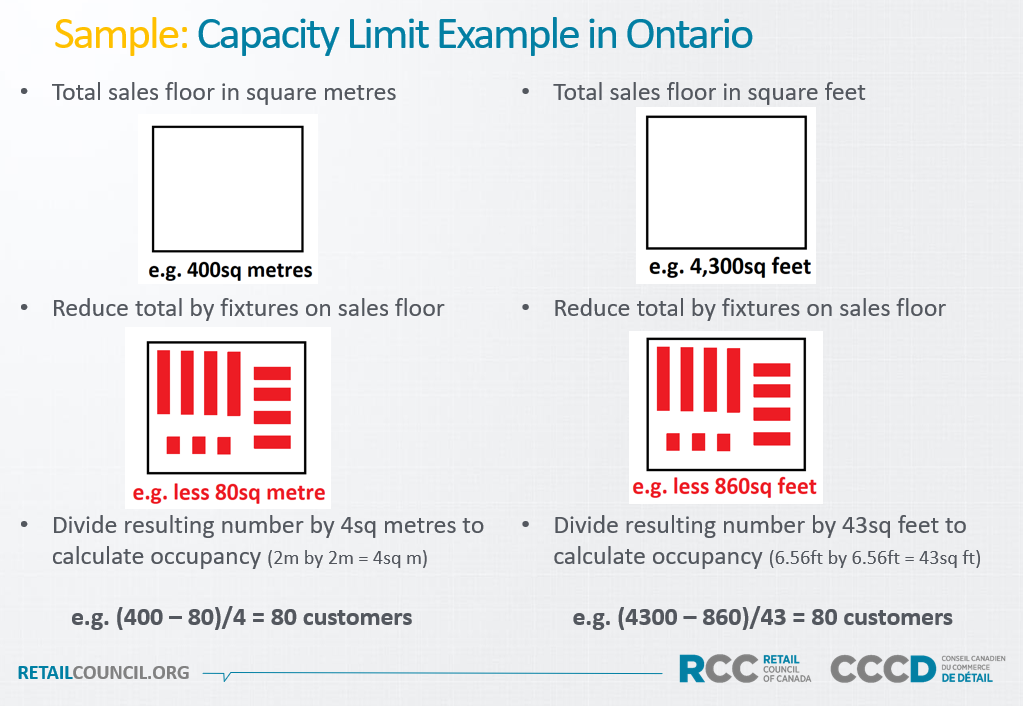

Ontario Rcc S Store Capacity Limit Calculation Tool Updated Retail Council Of Canada

Did You Receive A Letter From The Irs Taxes Irs Lettering Tax Deductions

Download Canadian Payslip Paystub Maker For Free Good For Employers And Employees Canada Payroll Checks Maker

Ontario Income Tax Calculator Wowa Ca

Quickly Estimate Your 2020 Taxes With Our Simple And Free Calculator See How An Rrsp Contribution Can Increase Your Refund Calculator Income Tax Tax

Calculating Free Cash Flow Free Cash Cash Flow Cash

How To Calculate Your Net Worth Financial Calculators Net Worth Savings Bonds

Ontario Sales Tax Hst Calculator 2021 Wowa Ca

Grade 6 New Ontario Math Financial Literacy Financial Literacy Elementary School Math Literacy

Cra Is About To Come Knocking Are You Ready In 2021 Investing Money Income Tax Emergency Response

Apply Online For Best Hero Fincorp Car Loans In India Compare Auto Loan Interes Apply Compare Fincorp India Interes Loans Online

Canada Federal And Provincial Income Tax Calculator Wowa Ca

Median And Average Income In Canada And The Us Freedom 35 Blog Average Income In Canada V 2020 G

Pin On Preschool And Kindergarten Worksheets

Are You A Canadian With Type 1 Diabetes Looking To Apply For The Disability Tax Credit Tax Credits How To Apply Type 1 Diabetes

Simpletax 2017 Canadian Income Tax Calculator Income Tax Income Calculator

Post a Comment for "Take Home Pay Calculator Ontario 2020"