Calculating Fte For Paycheck Protection Program

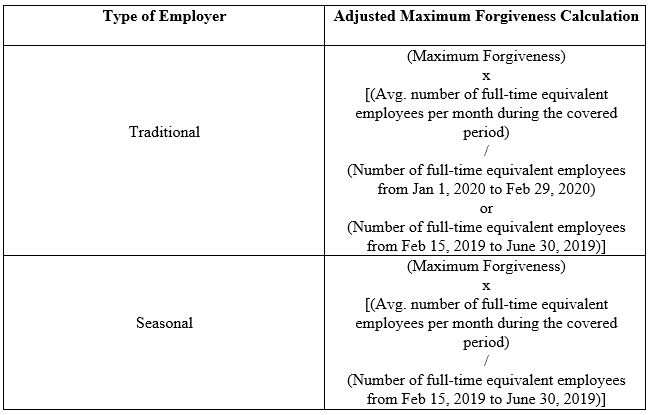

If borrower has 100000 in Forgivable Expenses but reduces the number of FTEs to an average of 90 FTEs per week during the Covered Period or. Until guidance is received otherwise we suggest using this computation to determine the FTEs for those employees who work fewer than 30 hours per week.

The loan amounts will be forgiven as long as.

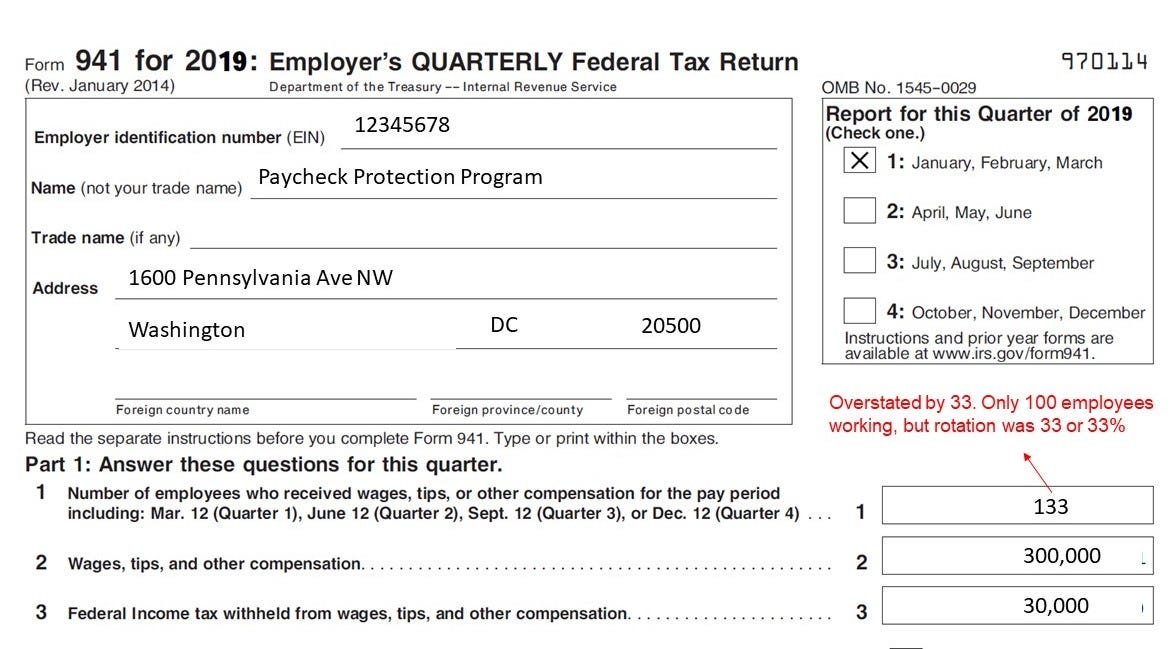

Calculating fte for paycheck protection program. This is understandable as the rules have changed a lot are quite confusing. Borrowers who together with their affiliates received loans totaling 2 million or greater cannot use form 3508S. As of 2021 PPP loans will cover additional expenses including operations expenditures property damage costs supplier costs and worker protection.

A full-time employee is an individual who works an average ofat least 30 hours per week. This calculator will assist in calculating the FTEs under 2 options. Calculating full-time equivalent employees depends on what you are computing the FTEs for.

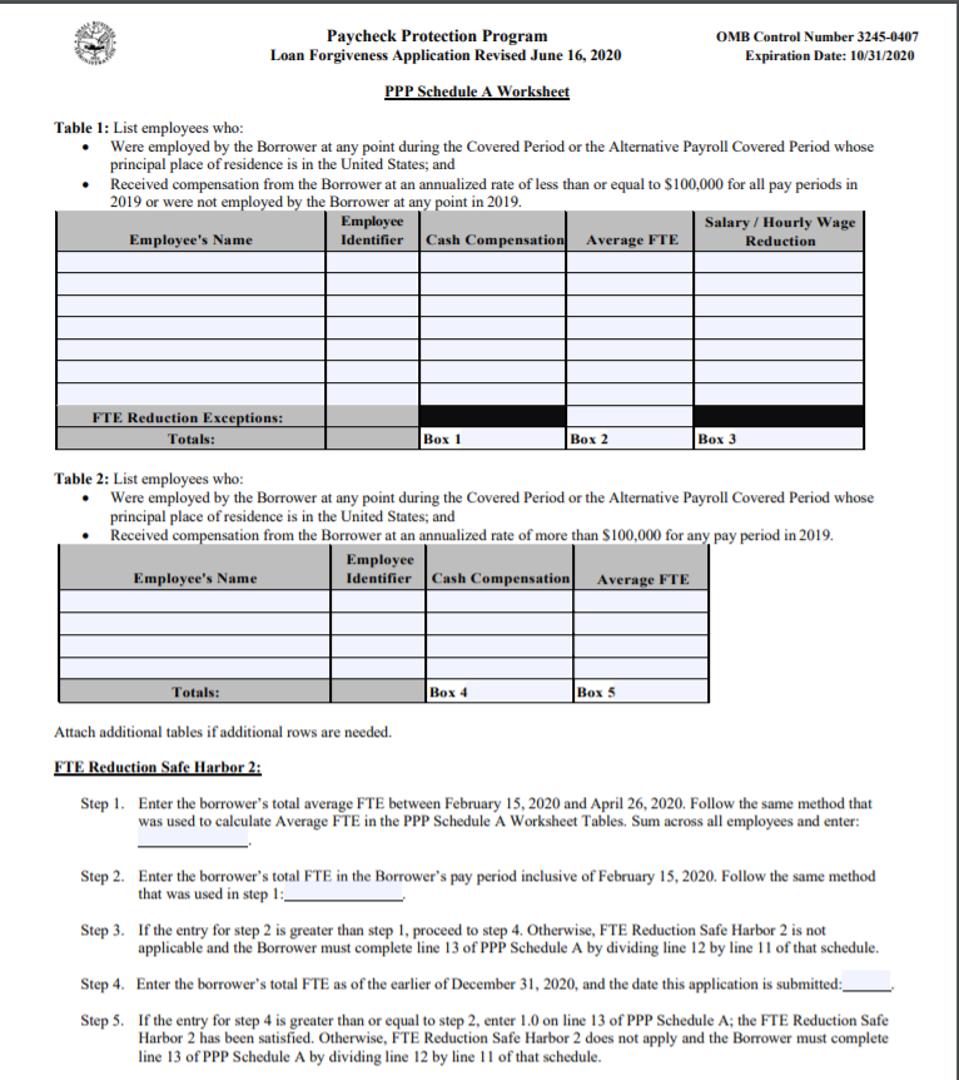

To apply for forgiveness of a Paycheck Protection Program PPP loan borrowers will be asked for a count of their full-time equivalent FTE employees. Hours paid each week 40 FTE. If the result is less than 075 multiply the lookback period value by 075 and subtract the covered period value.

July 2 2020. PAYCHECK PROTECTION PROGRAM PPP INFORMATION SHEET. 20 Hours X 3 Employee 60 Hours Devide it with 40 Hour result is your FTE 60 40 15 FTE Hencealtogether they would count as 15 FTE.

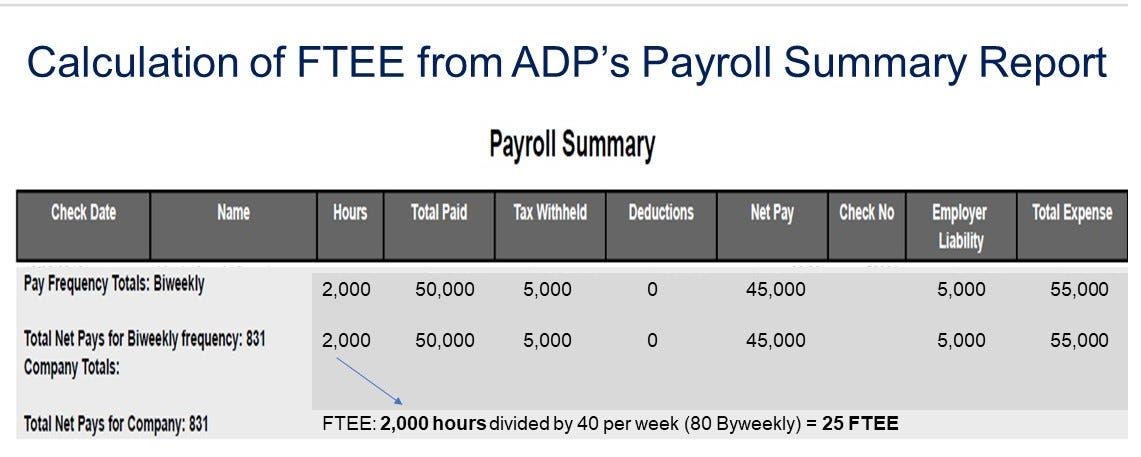

To calculate the average FTE for each employee Borrowers need to accumulate the total hours paid during the Covered Period and chosen Reference Period and divide the average number of hours paid per week during the relevant period by 40 and round to the nearest tenth. Average FTEs for the period between January 1 2020 and February 29 2020 loan period means the period beginning on the date the PPP loan is first disbursed by the lender and ending two years thereafter. All loan terms will be the same for everyone.

For example if you have 3 employees who consistently worked 20 hours a week altogether they would count as 15 FTE. As businesses have begun to wrap up their Paycheck Protection Program PPP loan covered period or decide whether to extend a little longer the number one question is around the full-time employee equivalent FTE or FTEE calculation. Calculate the average hours Download the PPP FTE Calculator.

What is the Paycheck Protection Program Flexibility Act of 2020. State and local taxes on employee compensation. FTE loan forgiveness calculation 1 The first way to calculate FTE is to take the average number of hours paid each week divide by 40 and round to the nearest tenth.

Divide by 40 and round to the nearest tenth to get your FTE calculation. For example if you have 3 employees who consistently worked 20 hours a week. How to calculate a full-time equivalent employee.

If the result is 075 or greater then the employee will not affect your forgiveness amount. BORROWERS The Paycheck Protection Program PPP authorizes up to 349 billion in forgivable loans to small businesses to pay their employees during the COVID-19 crisis. Add your full-time FTE and your part-time FTE to get your total FTE figure.

Total results for all employees that have salary or hourly wages decreased by greater than 25. Following is calculation for counting their combined FTE. A full-time equivalent employee isdetermined by adding the hours of part-time employees on amonthly basis and dividing by 120 IRC Section 4980Hc2E.

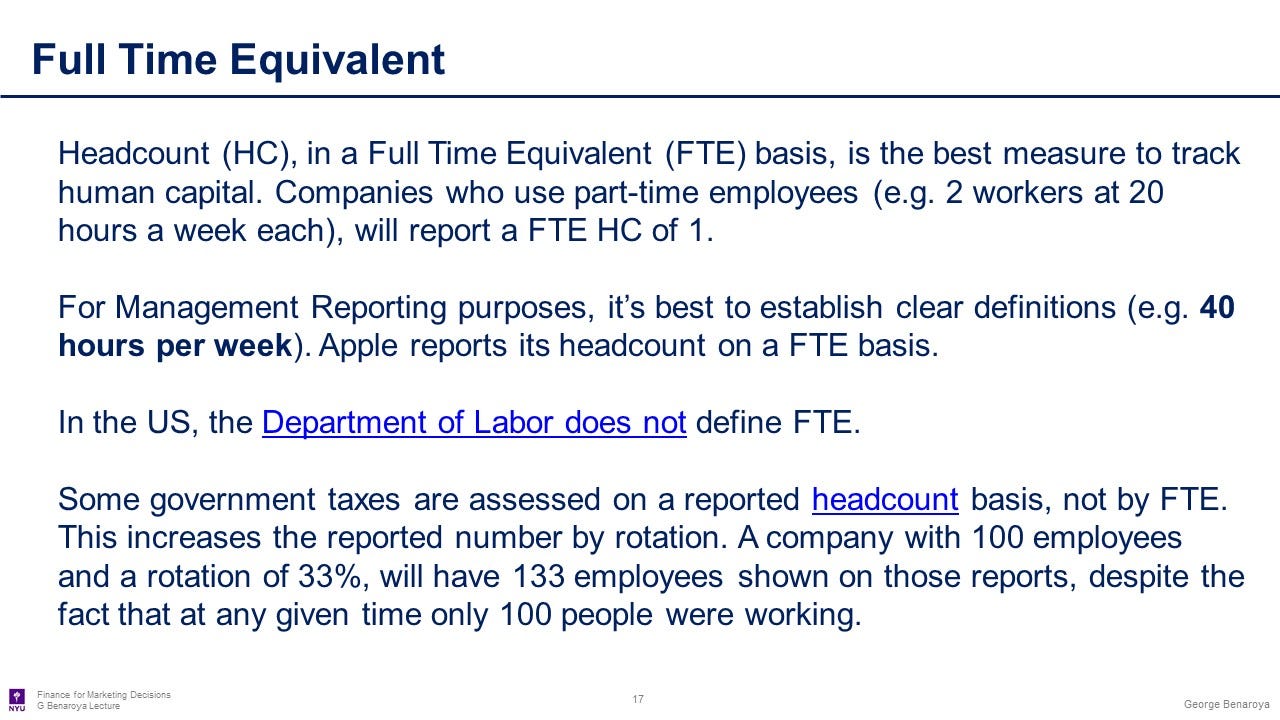

A full-time equivalent employee is determined by adding the hours of part-time employees on a monthly basis and dividing by 120 IRC Section 4980Hc2E. FTEs are calculated differently for each law or program. Monthly average FTEs means the number of FTEs determined by calculating the average number of FTEs per pay period during an.

The PPPFA gives the more than 48 million small business owners who secured upwards of 521 billion in relief funds through the PPP more time to spend proceeds from their loans more flexibility with how those funds can be used and more time to qualify for loan forgiveness. When you calculate full-time equivalent employees you generally find the average hours worked by your part-time employees during a certain period. If your PPP loan is 50000 or less you may be exempted from any reductions in loan forgiveness amount based on reductions in full-time equivalent FTE employees or reductions in employee salary or wages.

How To Calculate The Number Of Full Time Equivalent Employees Ftees By George Benaroya Medium

Fte Calculation Time Analytics Software Knowledge

How To Calculate Fte For The Ppp Bench Accounting

The Not Quite Definitive Guide To Paycheck Protection Program Loan Forgiveness

Loan Forgiveness Under The Paycheck Protection Program Updated To Include The Final Interim Rule Current Through May 22 2020 Forrest Firm

Ppp Loan Forgiveness Application How To Calculate Fte S Updated Template Youtube

Update To Paycheck Protection Program Ppp And Loan Forgiveness Considerations Maillie Llp

How To Calculate The Number Of Full Time Equivalent Employees Ftees By George Benaroya Medium

Ppp Loan Forgiveness Webinar Part Ii Questions Answers Adkf

Paycheck Protection Program Use Of Funds Forgiveness Documentation

Q Can You Provide An Example Of How To Calculate The New 40 Hr Fte For The Ppp Loan I M Confused If An Employer Needs To Look At Each Week Separately First

Determining The Number Of Full Time Employees Under The Paycheck Protection Program Of The Cares Act

How To Calculate The Number Of Full Time Equivalent Employees Ftees By George Benaroya Medium

Paycheck Protection Program Loan Forgiveness Application Loan Forgiveness Forgiveness Paycheck

Cutler Co Latest News The Not Quite Definitive Guide To Paycheck Protection Program Loan Forgiveness

Post a Comment for "Calculating Fte For Paycheck Protection Program"