Paycheck Calculator New York Long Island

There is also a supplemental withholding rate of. New Yorks estate tax is based on a graduated rate scale with tax rates increasing from 5 to 16 as the value of the estate grows.

Housing Works Bookstore Nyc Bookstore Nyc Neighborhoods Nyc

Heres a breakdown of.

Paycheck calculator new york long island. For 2020 the exemption will rise to 585 million. Number of Qualifying Children under Age 17. Local BAH rate charts for Military Housing Areas in the state of New York.

See the latest update on the 2021 Basic Allowance for Housing rates. The state as a whole has a progressive income tax that ranges from 400 to 882 depending on an employees income level. Our Premium Cost of Living Calculator includes Utilities Electric Bills Costs for Natural Gas Heating Oil Propane Comfort Indexes based on the year-round and seasonal weather and other must-know details.

2021 Cost of Living Calculator for Utilities Climate. Employers in Orlando FL typically pay -209 less than employers in New York NY. It is not a substitute for the advice of an accountant or other tax professional.

Choose Marital Status Single or Dual Income Married Married one income Head of Household. Click here to customize. New York Hourly Paycheck Calculator.

NY215 - Military Housing Area Name. Federal Hourly Paycheck Calculator. This federal hourly paycheck calculator is perfect for those who are paid on an hourly basis.

Use PaycheckCitys free paycheck calculators withholding calculators gross-up and bonus calculators 401k savings and retirement calculator and other specialty payroll calculators for all your paycheck and payroll needs. Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay. New Yorks income tax rates range from 4 to 882.

Taxpayers in New York City have to pay. The cost of living in Long Island NY is 100 percent higher than the national average. In 2018 the average millage rate in the county was 264 mills which would mean annual taxes of 7920 on a 300000 home.

The same type of job in the same type of company in Orlando FL will typically pay 47446. New York Payroll Taxes. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

BAH is assigned by location and pay grade rank and can be used to rent or purchase a home. However effective tax rates in the county are actually somewhat lower than that. If you make 55000 a year living in the region of New York USA you will be taxed 12213That means that your net pay will be 42787 per year or 3566 per month.

There is no income limit on Medicare taxes. The Paycheck Calculator may not account for every tax or fee that applies to you or your employer at any time. You would have to earn a salary of 32981 to maintain your current standard of living.

Supports hourly salary income and multiple pay frequencies. Check if you have multiple jobs. New York New York and Long Island Maine.

This free easy to use payroll calculator will calculate your take home pay. Your results have expired. One of a suite of free online calculators provided by the team at iCalculator.

145 of each of your paychecks is withheld for Medicare taxes and your employer contributes another 145. If you make more than a certain amount youll be on the hook for an extra 09 in Medicare taxes. The top tax rate is one of the highest in the country though only individual taxpayers whose taxable income exceeds 1077550 pay that rate.

Calculates Federal FICA Medicare and withholding taxes for all 50 states. The results are broken up into three sections. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for New York residents only.

Free salary hourly and more. Paycheck Results is your gross pay and specific deductions from your paycheck Net Pay is your take-home pay and Calculation Based On is the information entered into the calculator. The exemption for the 2019 tax year is 574 million which means that any bequeathed estate valued below that amount is not taxable.

For heads of household the threshold is 1616450 and for married people filing jointly it is 2155350. The New York Salary Calculator allows you to quickly calculate your salary after tax including New York State Tax Federal State Tax Medicare Deductions Social Security Capital Gains and other income tax and salary deductions complete with supporting New York state tax tables. Calculating taxes in New York is a little trickier than in other states.

Our paycheck calculator is a free on-line service and is available to everyone. Number of Allowances State W4 Pre-tax Deductions 401k IRA etc Check Date MMDDYYYY. Overview of New York Taxes New York state has a progressive income tax system with rates ranging from 4 to 882 depending on taxpayers income level and filing status.

The cost of living in Orlando FL is -450 lower than in New York NY. Below are your New York salary paycheck results. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

Calculate your New York net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free New York paycheck calculator. Your average tax rate is 222 and your marginal tax rate is 361This marginal tax rate means that your immediate additional income will be taxed at this rate. This New York hourly paycheck calculator is perfect for those who are paid on an hourly basis.

Nassau County lies just east of New York City on Long Island.

Alimony In New York The Complete Guide For 2021 Survive Divorce

New York Paycheck Calculator Smartasset

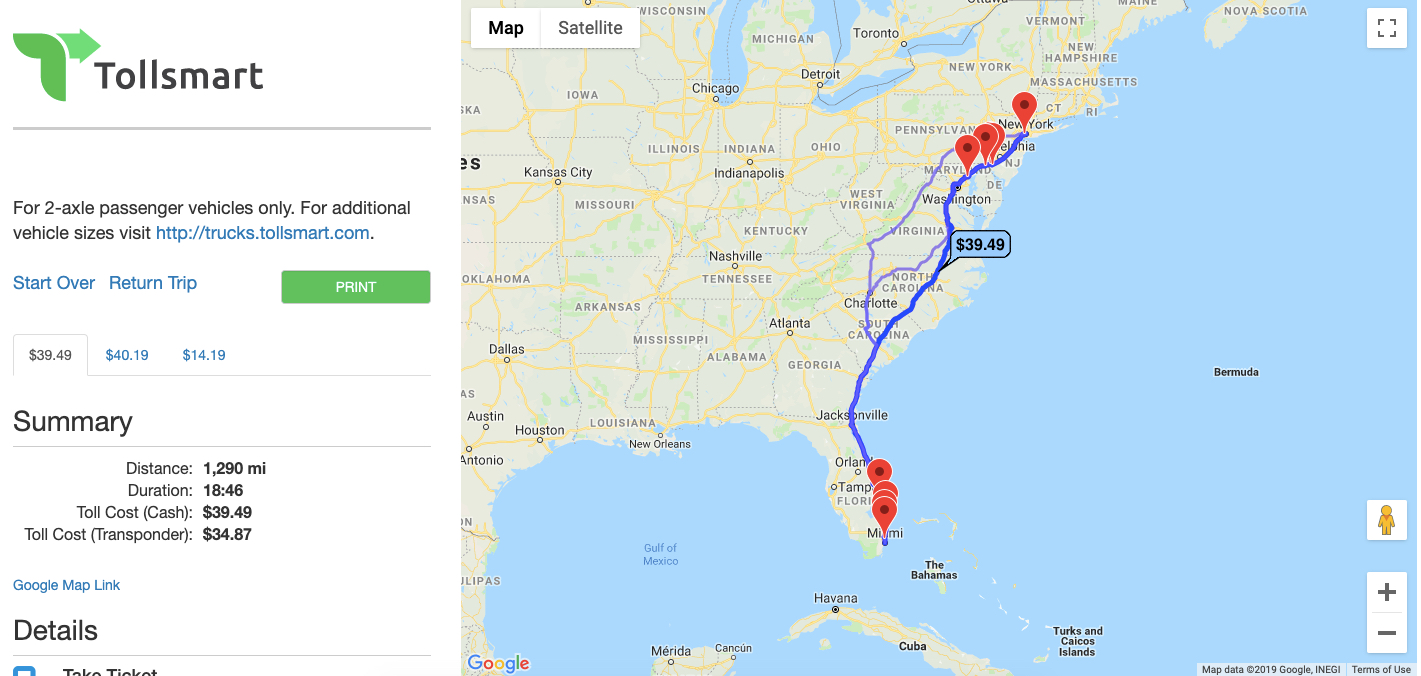

How Much Are The Tolls From Houston To New York Tollguru

Not Having A Buyers Agent Nyc Hauseit Buyers Agent Nyc Buyers

Tips For Choosing Do It Yourself Bankruptcy Software Bankruptcy Personal Bankruptcy Insolvency

Uwm Now Offering Mortgage Interest Rates As Low As 2 5 Housingwire Mortgage Mortgage Marketing Mortgage Loans

New York Paycheck Calculator Smartasset

Katz S Deli I Love Nyc Nyc New York

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

Nyc Mansion Tax Of 1 To 3 9 2021 Overview And Faq Hauseit

This Calculator Is Very Straight Forward It Uses The Following Set Of Recommendations To Calculate Your Daily Pro Protein Calculator Protein Weight Calculator

Nyc Mansion Tax Calculator For Buyers Interactive Hauseit

Free Google Maps Toll Calculator Tollsmart

New Tax Law Take Home Pay Calculator For 75 000 Salary

Bankruptcy Attorneys In Long Island Bankruptcy Attorneys Long Island

Post a Comment for "Paycheck Calculator New York Long Island"