Paycheck Calculator Los Angeles Hourly

Dont forget that this is the minimum figure as laid down by law. An employer may choose a higher rate of overtime pay.

2021 Attorney Fees Average Hourly Rates Standard Costs

Social Security and Medicare.

Paycheck calculator los angeles hourly. How much do you get paid. There are two paycheck calculators that compute paychecks for employees in Illinois and New York. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Overtime wages are a type of increased payment that employees can earn when they work more than a certain number of hours in a workday or workweek. Some companies pay 25 times the standard rate for overtime and sometimes even more. This California hourly paycheck calculator is perfect for those who are paid on an hourly basis.

Simply enter their federal and state W-4 information as well as their pay rate deductions and benefits and well crunch the numbers for you. Welcome to the FederalPay FWS Pay Calculator. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

The Federal Wage System FWS payscale is used to calculate the hourly wages for millions of blue-collar Government workers. SmartAssets California paycheck calculator shows your hourly and salary income after federal state and local taxes. For example if an employee earns 1500 per week the individuals annual income would be 1500 x 52 78000.

Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in California. Hourly paycheck calculator california. Living Wage Calculation for Los Angeles County California.

Important Note on the Hourly Paycheck Calculator. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Multiply the hourly wage by the number of hours worked per week.

Enter your pay rate. California Hourly Paycheck Calculator. Welcome to the FederalPay GS Pay Calculator.

Paycheck Calculators - MMC HR is an HRO and Payroll Services in Los Angeles California. The amount can be hourly daily weekly monthly or even annual earnings. California Salary Paycheck Calculator.

The General Schedule GS payscale is used to calculate the salaries for over 70 of all Federal government employees. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in California. Hourly daily weekly monthly annually.

Calculated based on different hourly pay rates that you enter along with the pertinent Federal State and local W-4 information. Paid by the hour. Enter your info to see your take home pay.

0 comments. Time and labor management benefits administration labor law. The Paycheck Calculator may not account for every tax or fee that applies to you or your employer at any time.

The calculator is updated with the tax rates of all Canadian provinces and territories. Paycheck calculator los angeles. Well do the math for youall you need to do is enter the applicable information on salary federal and state W-4s deductions and benefits.

You can use the calculator to compare your salaries between 2017 2018 2019 and 2020. Like the General Schedule payscale which applies to white collar employees the your pay under FWS largely depends on your Location the government installation you work at your Paygrade and your Step. The assumption is the sole provider is working full-time 2080 hours per year.

The living wage shown is the hourly rate that an individual in a household must earn to support his or herself and their family. Then multiply that number by the total number of weeks in a year 52. Wage for the day 120 11250 23250.

Calculate your California net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free California paycheck calculator. This hourly wage calculator helps you find out your annual monthly daily or hourly paycheck having regard to how much you are working per day week and pay rate. It will calculate net paycheck amount that an employee will receive based on the total pay gross payroll amount and employees W4 filing conditions such us marital status payroll frequency of pay payroll period number of dependents or federal and state exemptions.

Our 2021 GS Pay Calculator allows you to calculate the exact salary of any General Schedule employee by choosing the area in which you work your GS Grade and your GS Step. The calculator on this page is. Most nonexempt employees in California have a legal right to receive overtime wages when they work long hours1 The amount of overtime depends on the length of the employees shift and the number of days he or she has worked.

Payroll check calculator is updated for payroll year 2021 and new W4. Overtime pay of 15 5 hours 15 OT rate 11250. There is in depth information on how to estimate salary earnings per each period below the form.

For example if an employee makes 25 per hour and works 40 hours per week the annual salary is 25 x 40 x 52 52000. Usage of the Payroll Calculator. Overview of Federal Taxes When your employer calculates your take-home pay they will withhold money for federal and state income taxes and two federal programs.

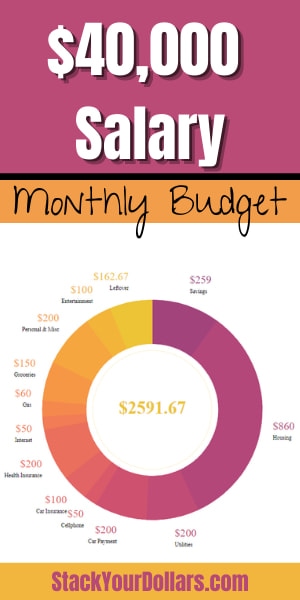

40 000 A Year Is How Much An Hour And Why That S A Good Salary Stack Your Dollars

Financial Methods Of Motivation Financial Methods 1 Time Rate Flat Rate Schemes This Payment Method Involves The Employee Rece Financial Motivation Basic

Uk Tax Calculator 2015 2014 2013 Salary Calculator 2013 Listentotaxman Paye Income Tax Calculator Payslip How Calculator Ideas Salary Calculator Repayment

Ekg Technician Average Salary In United States 2021 The Complete Guide

This Is What You Should Be Paying Your Baby Sitter Babysitter Sitter Oxnard

California Hourly Employee Paystub Generator Calistubs Com Microsoft Word Resume Template Business Template Professional Templates

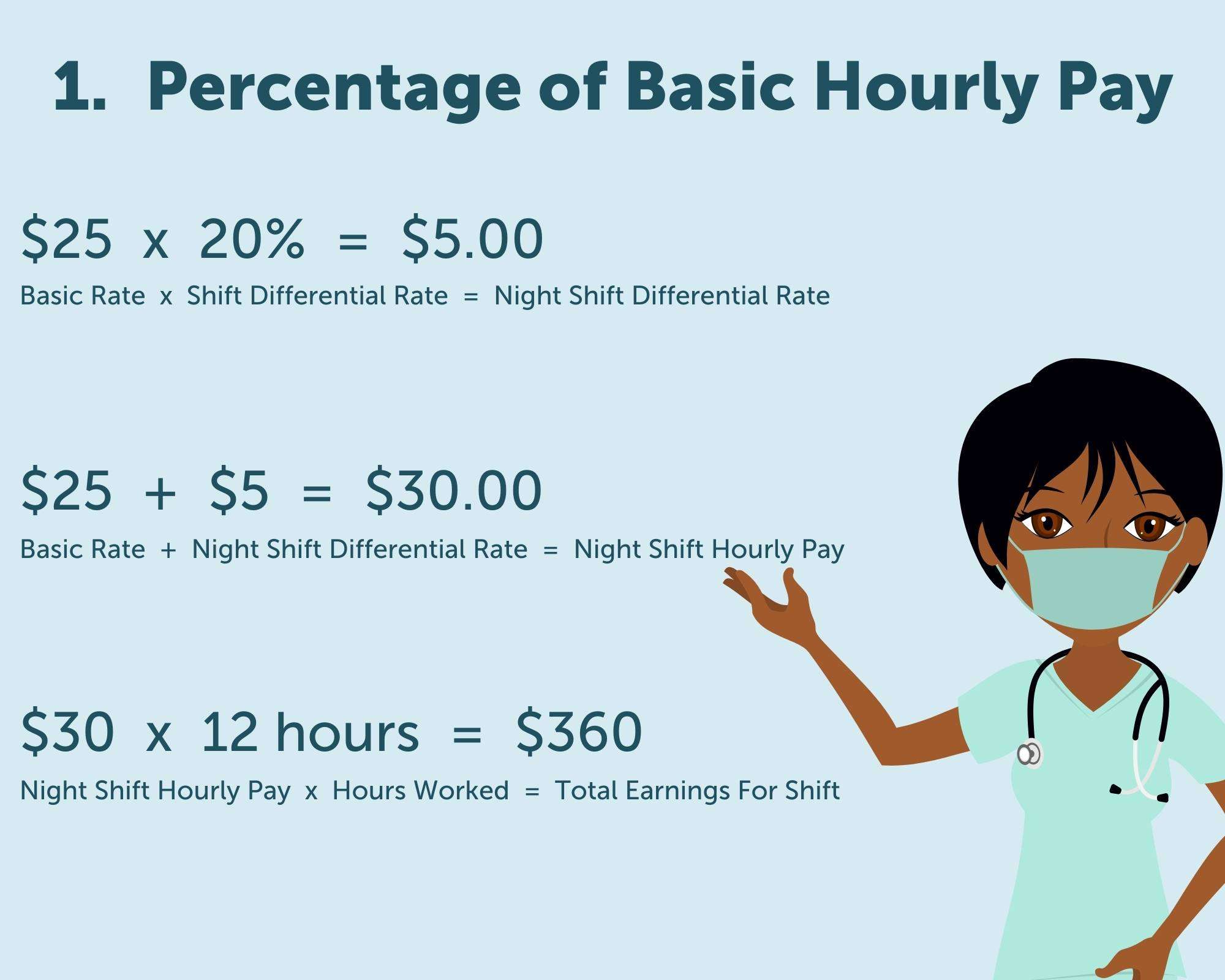

Shift Differential Pay Other Healthcare Payments Explained Aps Payroll

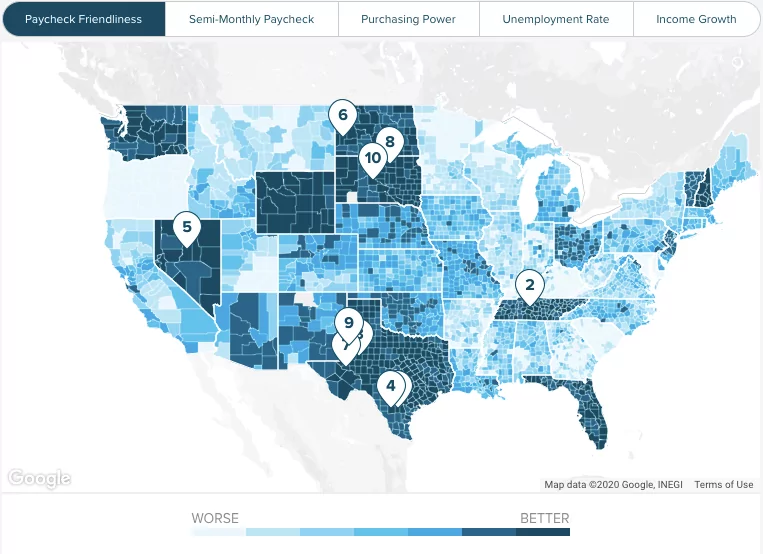

California Paycheck Calculator Smartasset

Nurse Salaries Which Us States Pay Rns The Best 2019 Updated

2021 Gross Hourly To Net Take Home Pay Calculator By State

California Paycheck Calculator Smartasset

Calculating Gross Pay Pdf Free Download

System Administrator Average Salary In United States 2021 The Complete Guide

How To Calculate Your Hourly Wage Financial Aid For College Financial Aid In God We Trust

Tipped Minimum Wage Restaurant Employee Pay In 2021

How Much Rent Can I Afford On My Hourly Pay My First Apartment

Pin On Translator Translate Translating Translation Localization Xl8 T9n L10n

How I Negotiated My Startup Compensation M Wetzler Of Keen Io Start Up Negotiation Job Opportunities

Post a Comment for "Paycheck Calculator Los Angeles Hourly"