Take Home Pay Calculator Quebec 2020

Calculate the tax savings your RRSP contribution generates. Canadian provincial corporate tax rates for active.

Salary Calculator 2020 21 Take Home Salary Calculator India

In Canada income tax is usually deducted from the gross monthly salary at source through a pay-as-you-earn PAYE system.

Take home pay calculator quebec 2020. Newfoundland Prince Edward Island Nova Scotia New Brunswick Quebec Ontario Manitoba Saskatchewan Alberta British Columbia Northwest Territories Nunavut Yukon. 1 2020 arent required to complete the form you may want to do so if youre changing jobs or adjusting your withholdings. Income Tax calculations and RRSP factoring for 202122 with historical pay figures on average earnings in Canada for each market sector and location.

It is perfect for small business especially those new to doing payroll. As a result your employer may be using a different Yukon Basic Personal Amount to calculate your pay. This federal bonus tax calculator uses supplemental tax rates to calculate withholding on special wage payments such as bonuses.

Bonus Tax Percent Calculator. Determine taxable income by deducting any pre-tax contributions to benefits. The calculator is updated with the tax rates of all Canadian provinces and territories.

Calculate your take home pay in 2021 thats your 2021 salary after tax with the Canada Salary Calculator. A quick and efficient way to compare salaries in Canada in 2021 review income tax deductions for income in Canada and estimate your 2021 tax returns for your Salary in Canada. Use this simple powerful tool whether your staff is paid salary or hourly and for every province or territory in Canada.

Or Select a state. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. The average monthly net salary in Canada is around 2 997 CAD with a minimum income of 1 012 CAD per month.

Anonymous accurate FREE way to quickly calculate the termination pay severance package required for an Ontario BC Alberta employee let go from a job. For the remainder of 2020 the CRA will expect this change to be implemented on a best efforts basis. This places Canada on the 12th place in the International Labour Organisation statistics for 2012 after France but before Germany.

Your average tax rate is 220 and your marginal tax rate is 353This marginal tax rate means that your immediate additional income will be taxed at this rate. Your employer withholds a 62 Social Security tax and a 145 Medicare tax from your earnings after each pay period. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

You can use the calculator to compare your salaries between 2017 2018 2019 and 2020. This is state-by state compliant for those states who. If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432That means that your net pay will be 40568 per year or 3381 per month.

Were making it easier for you to process your payroll and give your employees a great experience with their payslips. Personal Income Tax Calculator - 2019 Select Province. While those hired before Jan.

Although our salary paycheck calculator does much of the heavy lifting it may be helpful to take a closer look at a few of the calculations that are essential to payroll. The payroll calculator from ADP is easy-to-use and FREE. Enter your pay rate.

Personal Income Tax Calculator - 2020 Select Province. If you earn over 200000 youll also pay a. The Quebec Income Tax Salary Calculator is updated 202122 tax year.

To start complete the easy-to-follow form below. Newfoundland Prince Edward Island Nova Scotia New Brunswick Quebec Ontario Manitoba Saskatchewan Alberta British Columbia Northwest Territories Nunavut Yukon. Canadian corporate tax rates for active business income.

If your state does not have a special supplemental rate you will be forwarded to the aggregate bonus calculator. About the 2021 Quebec Salary Calculator. Were bringing innovation and simplicity back into the Canadian payroll market from new ways to pay your employees to our open developer program.

2021 - Includes all rate changes announced up to June 15 2021. This calculator is designed to show you how making a pre-tax contribution to your retirement savings plan could affect your take home pay. Salary paycheck calculator guide.

If this is the case you may see a difference between your pay and the Payroll Deductions Online Calculator. Usage of the Payroll Calculator. Salary calculations include gross annual income tax deductible elements such as Child Care Alimony and include family related.

The calculation is based on the 2021 tax brackets and the new W-4 which in. How to calculate net income. This calculator is intended for use by US.

The amount can be hourly daily weekly monthly or even annual earnings. When you make a pre-tax contribution to your retirement savings account you add the amount of the contribution to your account but your take home pay is reduced by less than the amount of your contribution. 2020 - Includes all rate changes announced up to July 31 2020.

It can also be used to help fill steps 3 and 4 of a W-4 form. When calculating your take-home pay the first thing to come out of your earnings are FICA taxes for Social Security and Medicare.

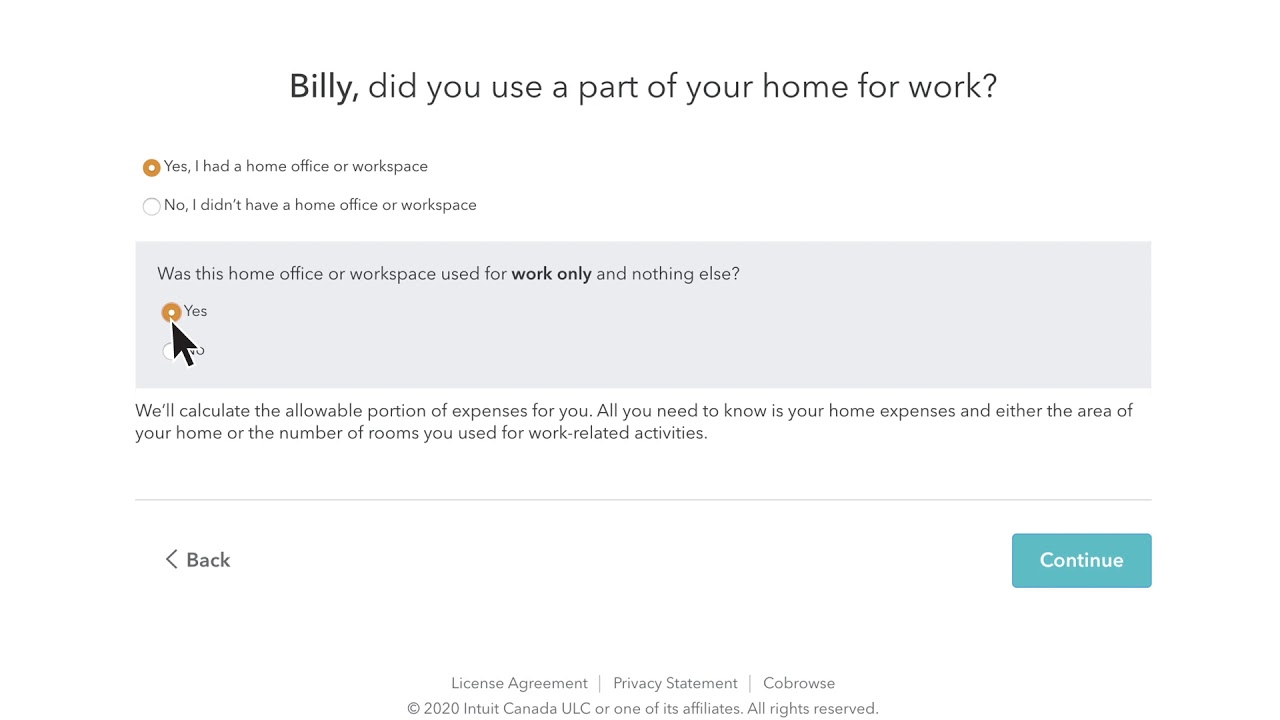

Home Office Deductions For Self Employed And Employed Taxpayers 2021 Turbotax Canada Tips

Median And Average Income In Canada And The Us Freedom 35 Blog Average Income In Canada V 2020 G

Vous Pensez Renover Votre Maison Vous Voulez Consolider Votre Hypotheque Montreal Nous Vous Rendons Tout Ca Buying Your First Home Home Loans Mortgage Rates

Canada Immigration Consultants Post Secondary Education Student Studying Overseas Education

Get Started With Bim 10 Phases To A Successful Bim Implementation Strategy Infographic Building The Digital Building Information Modeling Strategy Infographic Bim

Les 10 Series Tele A Voir Absolument En 2020 Elle Quebec Smart Home Living Room Accessories Woven Shades

Mortgage Calculator Mortgage Calculator Landmark Finance Calculations Can Become Seriously Troublesome Owing To Online Mortgage Home Mortgage Reverse Mortgage

Calculate Credit Card Payments Costs Within Credit Card Interest Calculator Excel Template Interest Calculator Credit Card Interest Excel Templates

Download Canadian Payslip Paystub Maker For Free Good For Employers And Employees Canada Payroll Checks Maker

Mortgage Calculator Mortgage Calculator There Ar Many Folks Advertising With Cas Mortgage Payoff Calc Refinance Mortgage Mortgage Amortization Mortgage Loans

Monthly Loan Amortization Schedule Excel Template Amortization Schedule Excel Templates Loan Calculator

Working From Home Tax Deductions Covid 19

The 20 Best Things To Do In Canada In Winter Canada Destinations Canada Travel Canadian Travel

Quebec Income Calculator 2020 2021

20 Passive Income Ideas To Make Money From Home Passive Income Make Money From Home Income

Canada Pnp Know Your Eligibility I 2020

How To Calculate Australia Gst In 2021 Australia Goods And Services Goods And Service Tax

Post a Comment for "Take Home Pay Calculator Quebec 2020"