How To Calculate 401k Contribution Per Paycheck

If you do the math you are investing 17850 each paycheck. 401k Calculator Payout The 401k payout calculator is calculated by 401k balance at retirement years of retirement investment growth rate and income tax rate to calculate your payout from 401k account.

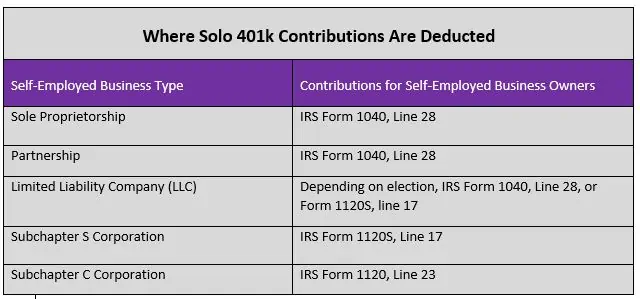

Solo 401k Contribution Limits And Types

When you make a pre-tax contribution to your retirement savings account you add the amount of the contribution to your account but your take home pay is reduced by less than the amount of your contribution.

How to calculate 401k contribution per paycheck. Your expected annual pay increases if any. According to the BLS only 56 of employers even offer 401 k plans and among those 49 match 0 41 will offer a match equivalent to 0-6 of the employees salary and 10 will offer a match of 6 or more. In the following boxes youll need to enter.

If you only contribute 3 your contribution will be 3000 and your employers 50 match will be 1500 for a total of 4500. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. If you increase your contribution to 10 you will contribute 10000.

For example lets assume your employer has a 50 match up to a maximum of 6 of your annual salary. This number is the gross pay per pay period. That represents an increase in your take home pay compared to what would happen if you contributed the same amount to a taxable account.

Definition of a 401k Account. Use this contribution calculator to help you determine how much you will have saved in your 401k fund when you retire. If you increase your contribution to 10 you will contribute 10000.

Subtract any deductions and payroll taxes from the gross pay to get net pay. To calculate your payroll tax for pretax 401k contributions you will calculate your gross wages minus your 401k contributions so you can determine your federal Medicare and. This is the same site that is featured in the video above.

The total 401 k contribution from you and your employer would therefore be 13000. Your 401k balance at retirement is calculated by the 401k calculator. How frequently you are paid by your employer.

It provides two important advantages. If you have an annual salary of 100000 and contribute 6 your contribution will be 6000 and your employers 50 match will be 3000 6000 x 50 for a total of 9000. If you have an annual salary of 25000 and contribute 6 your annual contribution is 1500.

The total 401 k contribution from you and your employer would therefore be 13000. So if you have a employer that matches 6 or more of your 401 k contribution that is extremely good. If the employee defers 4 of compensation or 2000 over the course of the entire year then the employers matching contribution will also be 2000 for the year.

The result should then be divided by your gross salary per paycheck to learn the contribution percentage. If you arent contributing to a 401k you are basically working for less pay since this contribution from the employer is a benefit added to the salary. This is true regardless of the actual contribution each pay period.

Loan repayment is probably the most common reason that W-2 employees make lump sum payments into their 401k plans. For example consider an employee earning 50000 per year in a plan offering a 100 match to 4 of compensation. Your annual gross salary.

You only pay taxes on contributions and earnings when the money is withdrawn. If you come into some money or leave your job with a loan outstanding you should have the option to pay off the debt earlyTo do so you can often write a personal checkbut check with your plan administrator to see if another form of payment is required like a cashiers. Plugin your own financial numbers at Paycheck City to see how your paycheck would be affected by a 401k.

First all contributions and earnings are tax-deferred. Effect of a 401k Over a Year. A 401k is an employer-sponsored retirement plan that allows you to relegate a percentage of your paycheck into future retirement savings.

401k Contribution Effects on Your Paycheck Calculator An employer-sponsored retirement savings account could be one of your best tools for creating a secure retirement. Your employers 50 match is limited to the first 6 of your salary then limits your employers contribution to 3000 on a 100000 salary. Your employers 50 match is limited to the first 6 of your salary then limits your employers contribution to 3000 on a 100000 salary.

Maximize Employer 401k Matching. The amount of your current contribution rate how much youre currently contributing to your plan account.

I Created A Little Calculator To Figure Out Exactly What My 401k Contribution Election Should Be To Front Load It Early Each Year Reach The Annual Max And Still Get The Full

How Do 401 K Tax Deductions Work

The Maximum 401 K Contribution Limit For 2020 Goes Up By 500

401k Contribution Impact On Take Home Pay Tpc 401 K

The Maximum 401k Contribution Limit Financial Samurai

The Maximum 401 K Contribution Limit For 2020 Goes Up By 500

Do You Know How Much You Are Contributing To Your 401k Every Pay Period The 2019 Contribution Limits For Your 401 Investing For Retirement Opening An Ira Ira

Free 401k Calculator For Excel Calculate Your 401k Savings

401k Savings By Age How Much Should You Save For Retirement

401k Contribution Impact On Take Home Pay Tpc 401 K

What Is A 401 K Match Onplane Financial Advisors

Solo 401k Contribution Limits And Types

Solo 401k Contribution Limits And Types

What Are The 401 K Contribution Limits For 2021 Ramseysolutions Com

Solo 401k Contribution Limits And Types

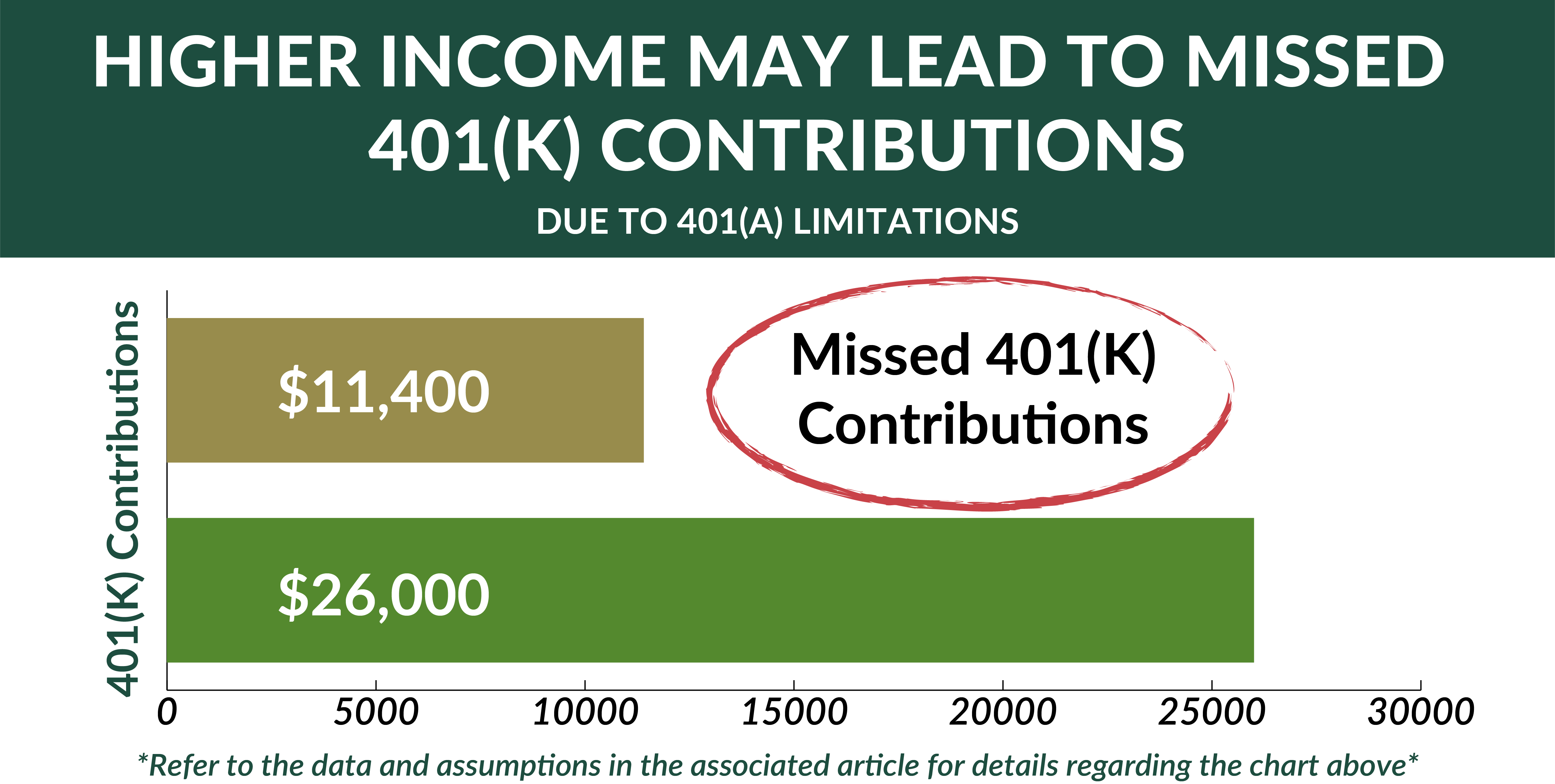

The 401 K Mistake Executives Earning Over 290 000 Make All The Time

Post a Comment for "How To Calculate 401k Contribution Per Paycheck"