Paycheck Calculator With Roth 401k Contribution

That makes a total of 12k annual contribution from both parties. To get a detailed future analysis of your 401k fill out the 401k Future Value Analysis form below.

Roth Solo 401k Contributions My Solo 401k Financial

Traditional 401k and your paycheck.

Paycheck calculator with roth 401k contribution. There are exceptions but thats the gist. If the participant elects to designate a portion of their elective deferrals as a Roth contribution then the designated contribution is taxed immediately and placed in a Roth 401k account. This is the percent of your gross income you put into a after tax retirement account such as a Roth 401k.

401k Planner Estimate the future value of retirement savings based on the interest rate contribution amount and current balance. First divide your annual salary by the number of pay periods per year to calculate your gross income per pay period. With sensible diversification elsewhere in your investment portfolio your 401k is an important part of planning for retirement.

A Roth 401k is a retirement savings plan for qualified employees. ROTH 401 - AFTER TAX. The 401 k calculator can estimate a 401 k balance at retirement as well as distributions in retirement based on income contribution percentage age salary increase and investment return.

The maximum annual IRA contribution of 5500 is. Second multiply your gross income per pay period by the percentage youve elected to contribute to your Roth 401 k plan to determine your 401 k plan withholding. This is the percentage of your annual salary you contribute to your 401k plan each year.

If the deduction is based on a percentage well use the gross pay to calculate the amount that will then be deducted from the employees net pay. As of January 2006 there is a new type of 401k -- the Roth 401k. Roth 401k contributions allow you to contribute to your 401k account on an after-tax basis and pay no taxes on qualifying distributions when the money is withdrawn.

Read the Plan Document. The Growth Chart and Estimated Future Account Totals box will update each time you select the Calculate or Recalculate. Obviously it cant be gross-taxes for pre-tax deferrals or youd have a circular function.

Roth 401k contributions allow you to contribute to your 401k account on an after-tax basis and pay no taxes on qualifying distributions when the money is withdrawn. 12k will be tax deferred and also invested into the 401k Traditional Funds. A 401k can be an effective retirement tool.

A 401k Affects your paycheck by withdrawing a percentage of your paycheck and investing it for you in a plan that is sponsored by an employer to grow over time and be available to you upon retirement which is defined by the age of 59 12. Your 401k plan account might be your best tool for creating a secure retirement. The amount you will contribute to your Roth IRA each year.

Gross Pay Calculator Plug in the amount of money youd like to take home each pay period and this calculator will tell you what your before-tax earnings need to be. A 401k can be an effective retirement tool. This rule may not apply to all plans.

Roth 401k 403b 457b Calculator This tool compares the hypothetical results of investing in a Traditional pre-tax and a Roth after-tax retirement plan. The employer match is 100 which is another 6k. You only pay taxes on contributions and earnings when the money is withdrawn.

While your plan may not have a deferral percentage limit this calculator limits deferrals to 80 to account for FICA Social Security and Medicare taxes. Calculate your earnings and more. 6 from 100k is 6k.

How to use the Contribution Calculator. A 401k can be an effective retirement tool. When you make a pre-tax contribution to your retirement savings account you add the amount of the contribution to your account but your take home pay is reduced by less than the amount of your contribution.

Calculate your earnings and more. Earnings on the account accumulate tax-free. As the TPA401k vendor to show you where it states compensation for Roth deferrals.

Let me help share information about setting up Roth 401k. In the end its going to get back to what your plan document states and then you have to get your payroll system to calculate it correcty. Plus many employers provide matching contributions.

Whether you participate in a 401k 403b or 457b program the information in this tool includes education to assist you in determining which option may be best. For example say you are paid monthly your annual salary. This calculator is designed to show you how you could potentially increase the value of your retirement plan account by increasing the amount that you contribute from each paycheck.

This calculator is designed to show you how making a pre-tax contribution to your retirement savings plan could affect your take home pay. How a 401k Affects Your Take Home Pay. When calculating the Traditional it seems pretty easy.

Roth 401k contributions are a relatively new type of 401k that allows you to invest money after taxes and pay no taxes when funds are withdrawn later for many investors this is a more appealing option than a traditional 401k. Below are your federal 401k details and paycheck information. A Roth 401k plan is a type of retirement plan.

Roth 401k plan withholding. As of January 2006 there is a new type of 401k contribution. As of January 2006 there is a new type of 401k contribution.

Use this calculator to see how increasing your contributions to a 401k can affect your paycheck and your retirement savings. Contributions are deducted from an employees check after federal and state taxes are calculated. Roth ira conversion 401 k savings with profit sharing roth 401 k vs.

Federal 401k Calculator Results. Roth vs Traditional 401k Calculator. While your plan may not have a deferral percentage limit this calculator limits deferrals to 75 to account for FICA Social Security and Medicare taxes.

The 6 is taken from the gross. This calculator assumes that you make your contribution at the beginning of each year.

The Maximum 401k Contribution Limit Financial Samurai

Roth 401 K Vs 401 K How To Decide Which Plan Is Best For You

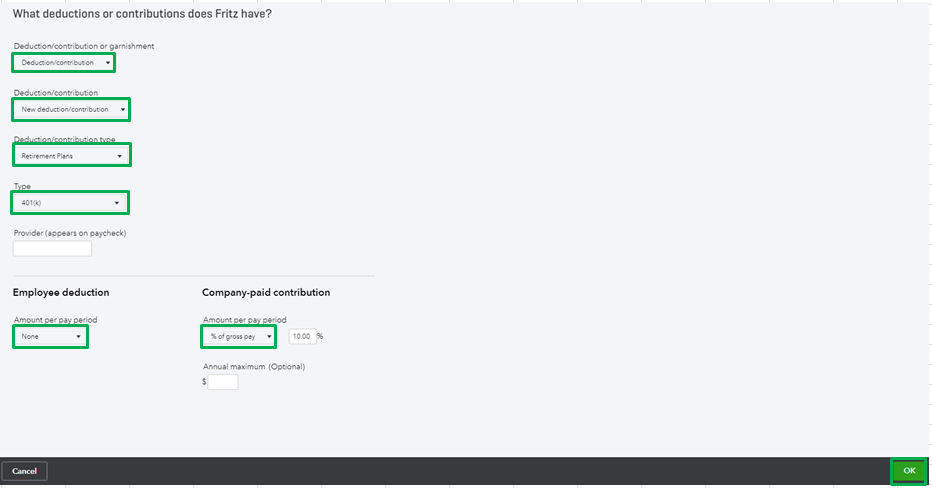

Solved After Tax Roth 401 K Employee Deductions Compan

Traditional 401 K Vs Roth 401 K Ubiquity

401k Vs Roth 401k Vs Roth Ira Scrubs Money Life

The Pros And Cons Of A Roth 401k

The Tax Trick That Could Get An Extra 56 000 Into Your Roth Ira Every Year

Traditional 401 K Vs Roth 401 K Ubiquity

Roth Solo 401k Contributions My Solo 401k Financial

Infographic How Does Saving 10 In Your 401 K Affect Your Paycheck

The Ultimate Roth 401 K Guide District Capital Management

401k Contribution Impact On Take Home Pay Tpc 401 K

Pin On Important Documents And Papers

The Ultimate Roth 401 K Guide District Capital Management

The 401 K Mistake Executives Earning Over 290 000 Make All The Time

Vanguard Consider The Advantages Of Roth After Tax Contributions

Roth Ira Vs 401 K Which Is Better For You Roth Ira Investing For Retirement Investing Money

/how-do-401k-tax-deductions-work-90f14263254d470fb07b75f2bf664174.png)

Post a Comment for "Paycheck Calculator With Roth 401k Contribution"